How to Calculate YTM Excel: A Guide to Yield to Maturity

Learning how to calculate YTM in Excel is key for investors. Yield to Maturity (YTM) shows the yearly return from a bond bought at today’s price and held till it matures. It’s important because it includes the bond’s price, interest rate, time left until it matures, and the chance of getting paid back.

In this YTM Excel tutorial, we’ll cover why YTM matters for smart money choices. We’ll also look at Excel tools for easy YTM calculations. You’ll see how the bond YTM formula helps compare different bonds, making it easier to pick the best ones.

Understanding Yield to Maturity (YTM)

Yield to maturity, or YTM, is the total return on a bond if held until it matures. It helps investors see the returns from fixed-rate securities like bonds. YTM is key for comparing investments and their potential.

What is Yield to Maturity?

The yield to maturity is the expected annual return on a bond until it matures. It looks at coupon payments, market price, and time left until maturity. YTM shows the expected return and is like the bond’s internal rate of return (IRR).

Importance of YTM in Bond Investing

Knowing YTM helps you make smart bond investment choices. Investors use YTM to compare bonds. It shows how market changes affect bond prices and yields. YTM also helps in managing portfolios by showing risk and return.

Key Components of YTM Calculation

To calculate YTM, you need to know a few key things. Important parts include:

| Component | Description |

|---|---|

| Coupon Payment (C) | The interest paid to bondholders regularly. |

| Face Value (FV) | The amount bondholders get back at maturity, usually $1,000. |

| Present Value (PV) | The bond’s current market price. |

| Time to Maturity (t) | The years left until the bond matures. |

Each part is crucial for figuring out the bond’s effective yield. They help see the expected returns, making YTM important in investment plans.

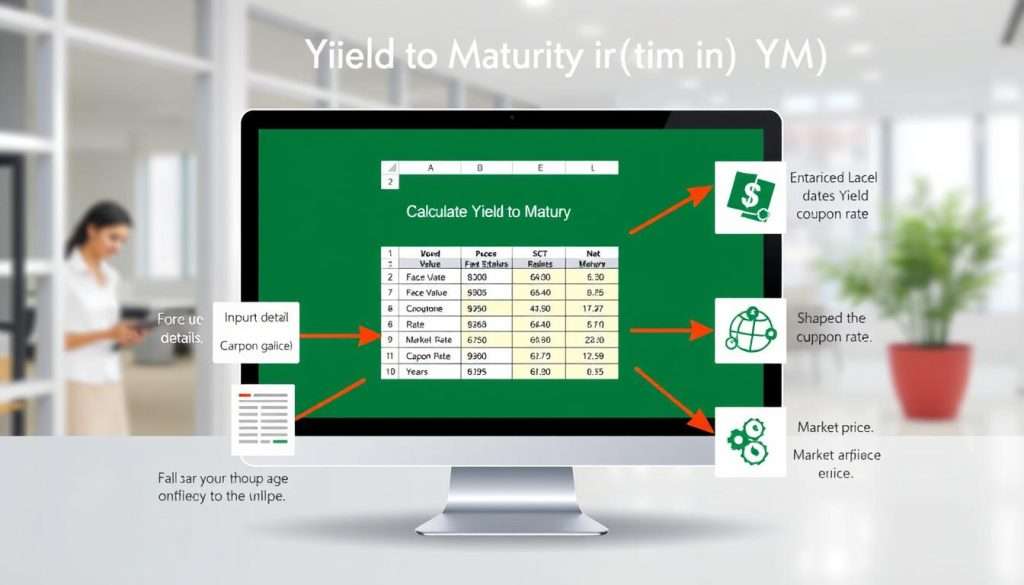

Setting Up Your Excel Spreadsheet

Creating a strong Excel spreadsheet for Yield to Maturity (YTM) is key for bond investors. We start by using the right excel functions for financial calculations. This helps us do precise bond evaluations.

It’s important to know about Face Value, Current Price, and Coupon Rate. These numbers greatly affect YTM calculations.

Accessing Excel Functions for Financial Calculations

Excel’s built-in formulas are very helpful for bonds. The YIELD and RATE functions are especially useful. They help us find a bond’s annual yield.

Using these functions makes our YTM analysis easier. The YIELDMAT function also helps us check bonds that pay interest at maturity.

Formatting Cells for Accurate Data Entry

Formatting cells in Excel makes our data clear and easy to read. Make sure to set up Face Value, Current Price, and Coupon Rate fields right. This keeps things clear and avoids mistakes.

For example, a bond’s Face Value is usually $1,000. Making sure this shows up as currency helps with calculations. Each part should match our ytm excel template. This template helps keep all our data in order.

The YTM Calculation Formula in Excel

Knowing how to calculate the Yield to Maturity (YTM) of a bond is key. It helps you make smart investment choices. We’ll look at the basic YTM formula and show you how to use Excel for these calculations.

The Basic YTM Formula Explained

The YTM formula in Excel needs some important details. These include the start and end dates, the interest rate, and the bond’s price and value. It works well for different situations, giving you the right yield results.

For example, let’s say you have a bond with certain features:

| Parameter | Value |

|---|---|

| Settlement Date | 15-Feb-08 |

| Maturity Date | 15-Nov-16 |

| Annual Coupon Rate | 5.75% |

| Price | $95.04 |

| Redemption Value | $100 |

| Frequency | Semiannual |

| Basis | 30/360 |

This bond has a YTM of 6.5%. It shows how these details are used in the formula. This is important for checking if the bond fits your investment goals.

How to Use Excel to Input the Formula

Using Excel makes it easy to put the formula in. First, set up your data in the spreadsheet. Make sure each piece of information is in the right place. This makes changing numbers and doing math easier.

For example, you can use this formula in Excel to find the yield:

=YIELD(settlement, maturity, coupon_rate, price, redemption, frequency, [basis])

Make sure dates are in a format Excel can understand. It’s also important to check your numbers. Wrong dates, negative rates, or wrong frequencies can cause problems. Excel helps make bond valuation easier and gives you insights for your investment plans.

Step-by-Step Guide to Calculate YTM in Excel

Using Excel to find the yield to maturity (YTM) is easy. This guide will show you how to do it step by step. You’ll learn how to make sure your calculations are right and fast.

Step 1: Gather Necessary Information

First, get all the important details about the bond. You need:

- Settlement Date

- Maturity Date

- Annual Coupon Rate

- Current Bond Price

- Redemption Value

- Number of Coupon Payments Per Year

This info is key for using the YTM formula in Excel. Make sure it’s up to date and right to avoid mistakes.

Step 2: Enter Data in Excel

Now, put the info into Excel. Make a new sheet and label each column with the info you have. For example:

| Parameter | Value |

|---|---|

| Settlement Date | 15-Feb-08 |

| Maturity Date | 15-Nov-16 |

| Annual Coupon Rate | 5.75% |

| Bonds Price | 95.04287 |

| Redemption Value | $100 |

| Number of Payments Per Year | 2 |

Put each value in the right row in your spreadsheet.

Step 3: Apply the YTM Formula

The last step is to use the YTM formula in Excel. You can use the YIELD function. The formula looks like this:

=YIELD(settlement, maturity, rate, price, redemption, frequency, [basis])

For our example, replace the parameters like this:

=YIELD(A2, B2, C2, D2, E2, F2, 0)

Hit Enter after typing this. Your YTM will show up, helping you compare it with other investments.

Using Excel Functions for YTM

Excel has many financial functions to help with Yield to Maturity (YTM) calculations. Knowing these ytm excel functions helps investors make smart choices about bonds and other securities. This part talks about key functions, like the YIELD function and how to use the using RATE function for ytm and excel ir functions.

Introduction to Excel Financial Functions

The YIELD function is a standout among ytm excel functions. It shows the annual yield of a security that pays interest at maturity. You need certain info to use it: the settlement and maturity dates, issue date, interest rate, security price, and a day count basis. It’s important to make sure the dates match because Excel uses them as numbers.

Utilizing RATE or IRR Functions

The using RATE function for ytm is another option for finding interest rates with constant cash flows. The IRR function, on the other hand, finds the internal rate of return for different cash flows. Both functions work well with YIELD, especially when you need to look at Yield to Call (YTC).

Interpreting the YTM Results

After finding the Yield to Maturity (YTM) for a bond, you get more than a number. It’s key to understand your YTM to make smart choices. For example, if Bond X’s YTM is 7.4%, you know you’ll get that return if you keep it until it matures.

But, if the market changes, like the bond’s price or interest rates, your YTM might change. For Bond X, the YTM went up to 13.8% after two years. This shows how your investment does against market changes.

Understanding Your Calculated YTM

When looking at bond YTM, think about how outside things might affect your plans. The YTM formula shows possible gains and risks. It’s important to study YTM to pick the right bonds for your money goals.

Also, things like bond price, coupon rate, and when it matures are key. These might need to change as the market does.

Making Investment Decisions Based on YTM

Using YTM to decide on investments is a good start. For example, if Debt Fund A might give you 10% in a year, YTM helps you see if it meets your hopes. YTM, along with other info, helps pick which bonds to keep.

By really getting YTM, you can make your portfolio better. This helps plan for future investments.